Emergency Rental Assistance Program FAQ's

Emergency Rental Assistance Program FAQ's

emergency rental assistance program

program faq's

What is the Fulton County COVID-19 Emergency Rental Assistance Program?

Fulton County has received $40 million through the United States Emergency Rental Assistance program. The purpose of Fulton County’s program is to provide financial assistance to eligible households for the payment of rent, rent arrearage, utility arrearage and other housing costs incurred due to the COVID-19 pandemic.

Who should apply?

Eligible households must reside within Fulton County but outside of the city of Atlanta. The Applicant should be an adult tenant in an eligible household.

An eligible household includes:

• one or more individuals within the household has qualified for unemployment benefits or experienced a reduction in household income, incurred significant costs, or experienced other financial hardship during or due, directly or indirectly, to the coronavirus pandemic;

• one or more individuals within the household can demonstrate a risk of experiencing homelessness or housing instability; and

• the household is a low-income family

What documentation do I need to apply?

If you are a tenant:

- CONTACT INFO: Your address, email and phone number

- ID: Valid Photo ID of all household member 18 years of age or older

- PROOF OF YOUR INCOME: Tax returns or wage statement

- LEASE: Lease Agreement or Documentation of Payments made

- EVICTION NOTICE: Copies of eviction notice or dispossessory notice (if applicable)

- UTILITIES: Past Due Water, Electric and Gas Utility notices. You will also need to enter the account numbers.

- UNEMPLOYMENT: Documentation of unemployment or loss of income since March 2020 if applicable

- PREVIOUS ASSISTANCE: Notices of any prior rental assistance you have received since March 2020 if applicable

- Any other documentation that indicates your risk of homelessness

- Your landlord’s Email Address

If you are a landlord:

- CONTACT INFO: Your email and phone number

- IDENTIFICATION NUMBER: Social Security number, tax identification number, or DUNS number

- W-9 Form: Completed and signed IRS W-9

- BUSINESS LICENSE: Current Business License

- LEASE: Lease Agreement

- LEDGER: Payment Ledger

Why do you need my personal information and documents?

This program is funded by the United States Treasury. The Treasury Department requires information and documentation to show that Fulton County has properly used the funds for this program. Required documentation includes information such as income information, social security numbers, and/or other information and documents.

Fulton County may need to provide the information you share with the Treasury Department to facilitate proper tracking use of funds. If you fail to provide any required information and/or documentation, your application may not be processed.

When can I apply?

Fulton County is accepting applications for the COVID-19 Emergency Rental Assistance Program. To apply visit, fultoncountyga.gov/renthelp or call 1-855-776-7912

If I have already received funding from the Program and now I need assistance for additional months of rent or utilities, can I receive a second round of funding?

The Program does not encourage Applicants to wait to request additional assistance if it is needed. Program funding is limited and additional assistance is not guaranteed.

emergency rental assistance program

form 1099-g Faq's

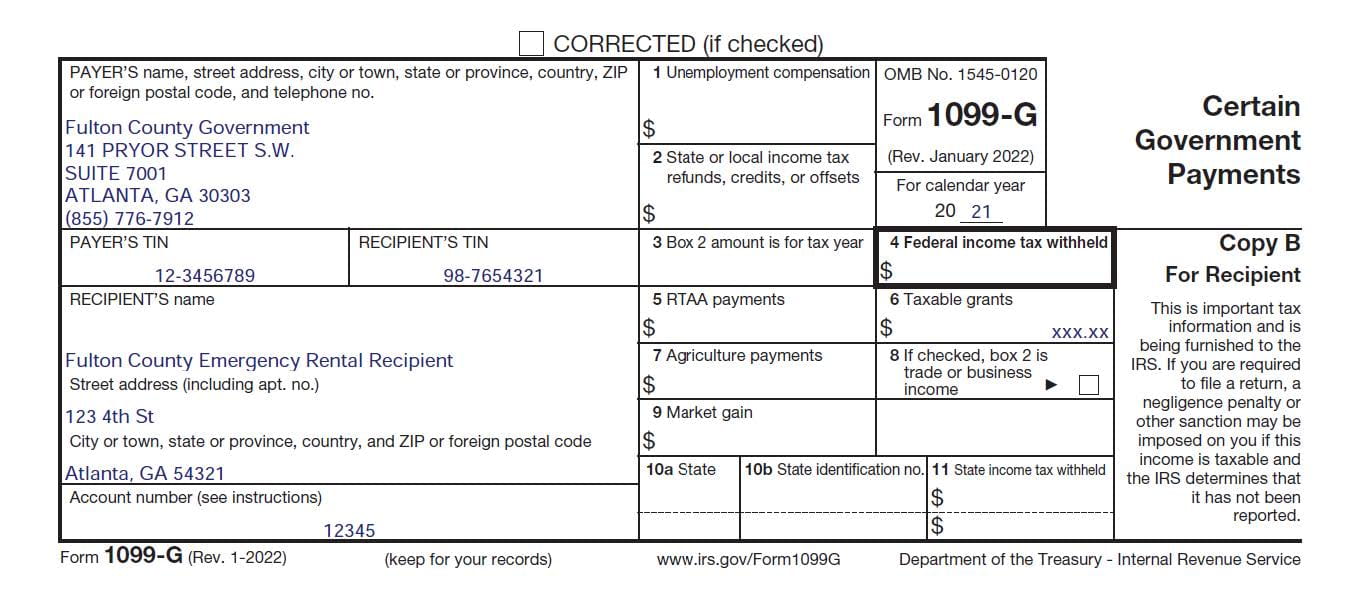

What does the Form 1099-G look like?

See below for a sample Form 1099-G.

What is Form 1099-G?

Form 1099-G is used by a government agency to inform you of funds you have received that you may need to report on your federal income tax return.

A copy is sent to the Internal Revenue Service (IRS) to report the funds and a copy is mailed to you to provide you with information you may need to file your federal income tax return.

Why am I receiving this form?

You are receiving this Form because you received payments from the Fulton County Emergency Rental Assistance Program during the 2021 calendar year.

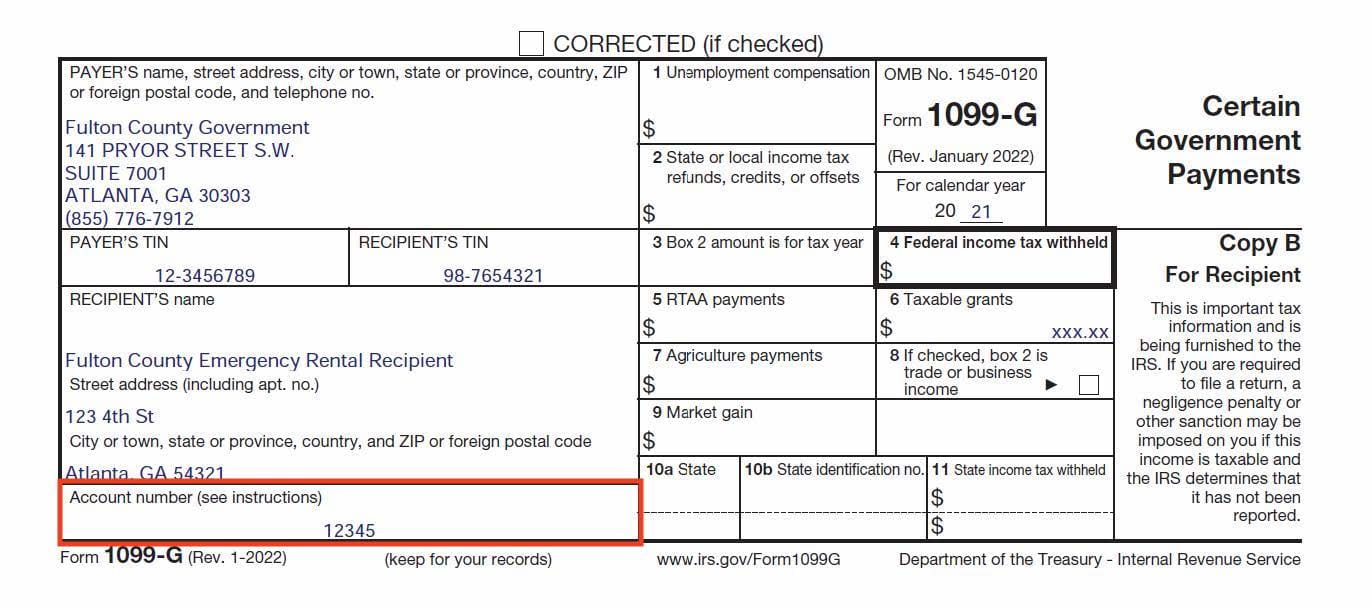

The Account number listed on Form 1099-G is a unique identifier to distinguish your account. This Account number will not match your Landlord ID (see sample form below).

What do I do with Form 1099-G? Do I need to take any action?

Why did I receive more than one Form 1099-G?

· Your business name or tax ID number changed during the year.

· You had multiple accounts / profiles set up with the Emergency Rental Assistance Program.

· You are a Landlord with a parent company that owns multiple rental properties.

· You received more than one payment from the Program. The agency issuing payments for the Fulton County Georgia Emergency Rental Assistance Program (FCG ERAP) changed after Program launch. Due to the timing of your payments, you received funding from more than one agency, resulting in the need for multiple 1099-G Forms.

Note: If you received multiple forms, the total of all forms should equal the total amount of assistance payments you received during the 2021 calendar year

The amount / name / TIN reported on the form is incorrect. What should I do next?

Does this form change my taxable income?

Please refer to the instructions provided by the IRS for Form 1099-G and consult with your tax preparer or an authorized tax adviser for instructions on how to use this form.

I received check payments from the Fulton County Emergency Rental Assistance Program. Why is the Form 1099-G from Fulton County Government?

I lost or did not receive my Form 1099-G. How can I get a copy?

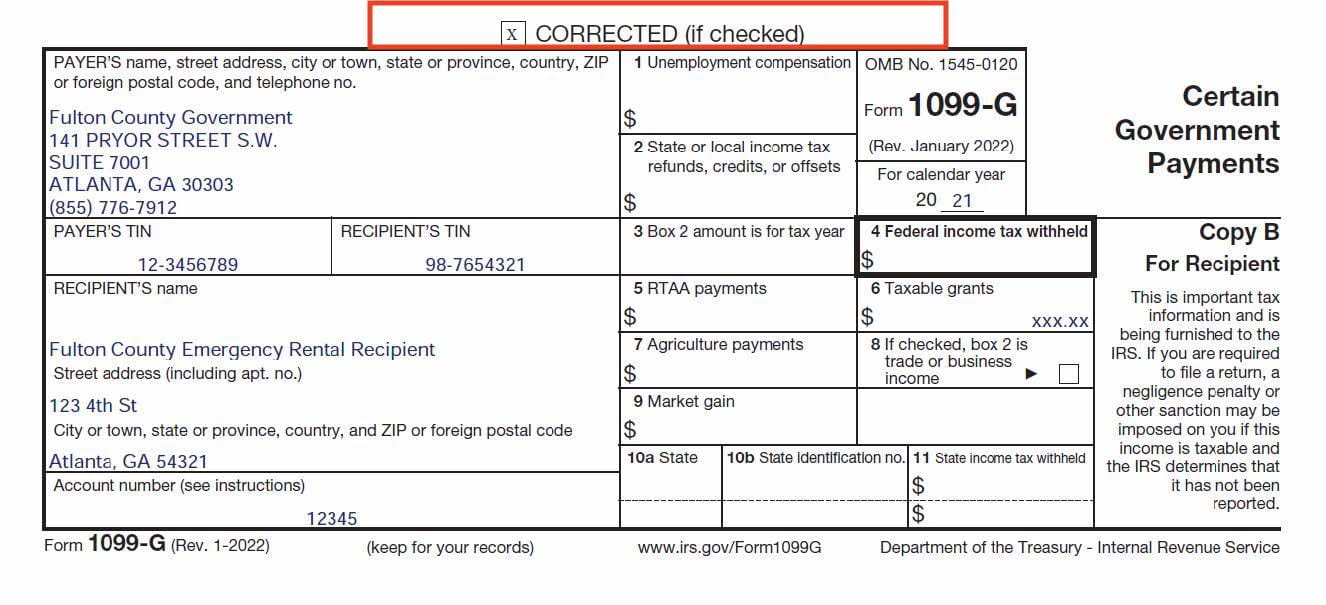

I received a corrected Form 1099-G, what should I do with the original form?

The Corrected Form 1099-G will show the corrected information. Use the Corrected Form 1099-G and do not reference the originally issued Form 1099-G.

Please refer to the instructions provided by the IRS for Corrected Form 1099-G and consult with your tax preparer or an authorized tax adviser for instructions on how to use this form.

Example of a corrected Form 1099-G is below:

I received a 1099-G after I filed my taxes. What do I do next?

I need to file an amended tax return, and I’m concerned about penalties or fees.

emergency rental assistance program

eligibility

Is there a maximum income to qualify for the Fulton County COVID-19 Emergency Rental Assistance Program?

Yes, there are limitations on the maximum household income to qualify for Fulton County COVID-19 Emergency Rental Assistance Program. Income caps are as follows:

| Household 1 | $46,350 |

| Household 2 | $52,950 |

| Household 3 | $59,550 |

| Household 4 | $66,150 |

| Household 5 | $71,450 |

| Household 6 | $76,750 |

| Household 7 | $82,050 |

| Household 8 | $87,350 |

I am a Landlord – may I apply?

Yes. If you are an owner/landlord who would like to become eligible to receive emergency rental assistance payments on behalf of your tenant, you must complete a Landlord Application in the Fulton County COVID-19 Emergency Rental portal.

If I have been making partial payments on my rent, may I apply?

What if I am not on the lease, and that person is not able to apply, but i live here and face eviction?

If an adult is living in leased property in Fulton County outside the City of Atlanta and faces the possibility of eviction, you should apply using the Tenant Application. You will be eligible if you meet the financial and other requirements for an eligible household.

I live in Atlanta. May I apply for this program?

No. This program was funded by the U.S. Government specifically for Fulton County residents outside the City of Atlanta. The City of Atlanta received its own funding.

I am not behind on my rent- just my utilities and fees to the LL or utility, may i still apply?

If I was evicted already, may I apply?

What if I do not have a written lease, but just pay month to month?

You are a tenant for purposes of this application, and you may file an application. However, you may be required to provide other evidence of the landlord/tenant relationship, such as proof of prior payment.

I am not a Tenant - I am a homeowner behind on my mortgage. May I apply?

No. This program only provides assistance for residential dwelling rental obligations.

I am homeless, may I apply for assistance?

Yes. If you otherwise qualify and already lost the occupancy of housing, you may apply to obtain financial assistance to pay the landlord and/or utility companies for the outstanding rental arrears and/or utility arrears.